Tax Brackets 2024 Nerdwallet Estimate – You’ll pay a higher price for underpaying estimated taxes. The IRS has raised its penalty interest rate for individuals, to 8% per year. This penalty is assessed for underpayment or late payment of . Federal income tax returns are due on April 15, but there are several other important dates to remember throughout the year. .

Tax Brackets 2024 Nerdwallet Estimate

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

Massachusetts State Income Tax: Rates and Who Pays in 2023 2024

Source : www.nerdwallet.com

2024 Tax Filing Guide: How to File Taxes This Year NerdWallet

Source : www.nerdwallet.com

Estimated Tax Payments 2023 2024: How They Work, When to Pay

Source : www.nerdwallet.com

50/30/20 Budget Calculator NerdWallet

Source : www.nerdwallet.com

IRS Announces 2024 Tax Brackets, Updated Standard Deduction

Source : www.nerdwallet.com

2024 Tax Filing Guide: How to File Taxes This Year NerdWallet

Source : www.nerdwallet.com

California Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com

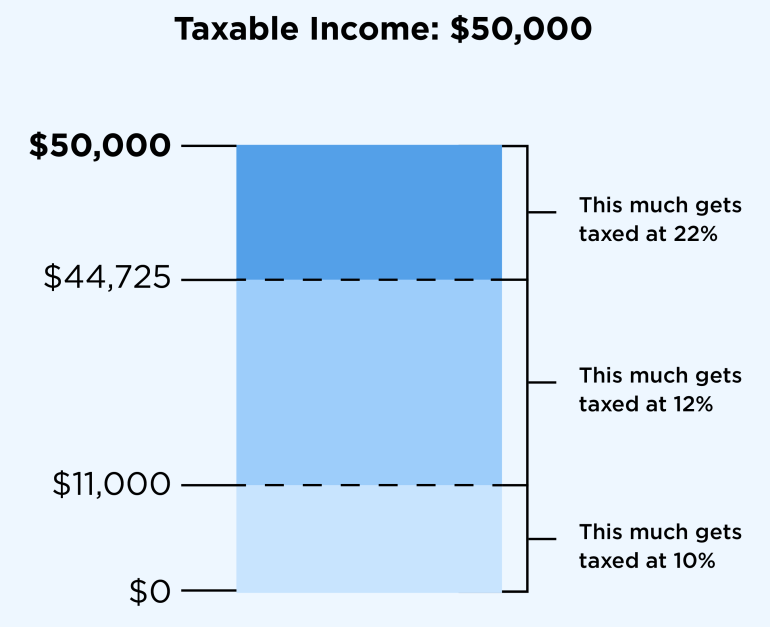

Tax Brackets 2024 Nerdwallet Estimate 2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet: It’s time to get prepared to file your taxes in early 2024. How soon can you file? Here are answers to questions you might be pondering. . Each bracket represents a range of incomes subject to a particular income tax rate. Tax brackets will rise again in 2024. 37% for according to NerdWallet. People who bought a house before .